Are you looking to finance your boat purchase? See what your estimated boat loan repayments will look like with our handy boat finance calculator. This easy-to-use online tool is here to help you plan your budget better and set your expectations when taking out a boat loan.

Our boat loan repayment calculator is a great place to start when estimating costs. If you want to have a more accurate boat finance quote, it’s best to get a quick quote online. Or you can get in touch with us to discuss your needs.

Why use a boat finance calculator?

A boat loan repayment calculator lets you estimate the costs of your loan even before talking to a lending specialist or broker. This is a great tool to use when you’re at the beginning of your boat loan search. Plugging the information into the calculator takes almost no effort while delivering useful information.

Using a boat finance calculator has a multitude of benefits such as:

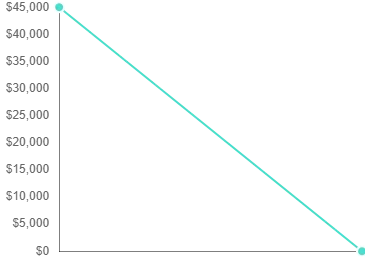

- Makes it easier to understand possible repayments. When you use the boat loan calculator, you can see how the loan amount, loan term, loan frequency, and interest rate can affect your total repayments. This will help you better understand the cost of the loan so you can budget better.

- Aids you in finding the cheapest boat finance option. Boat loan comparison is made easy with a boat finance calculator. You can plug in the interest rates and loan terms from different lenders and see which one is best suited to your needs.

- Convenient and saves you from crunching the numbers yourself. When doing boat loan comparisons, things can get complicated. Using a boat loan calculator saves you from the hassle and lets you compute possible repayments quickly.

How to use the boat loan repayment calculator

Using the Aussie Boat Loans calculator is a breeze. All you need to do is supply the needed information and input them into the calculator. You’ll get an estimate of what your boat loan repayments will look like with the data you’ve provided.

Adjust the fields to match the boat loan offers from different loan providers. Note, the loan amount is the amount you’re planning to borrow while the purchase price is the cost of the boat you intend to buy. If you don’t want to put in a deposit, the loan amount and purchase price will be the same.

What factors affect your boat loan?

When searching for the cheapest boat finance, you must be aware of how different aspects of the loan will affect your repayments and the total cost of the loan. Keep the following in mind when you’re using the boat finance calculator.

Initial deposit or trade-in value

Usually, boat loans don’t require a cash deposit, but it could help reduce the overall cost of the loan. If you have some funds ready, you can put down an initial deposit so you’re borrowing less. For those who are looking to upgrade their boat, they can use the trade-in value of that towards their boat loan.

Loan term

The loan term is the period you’re expected to pay off your boat loan. Boat loans could have three-year to five-year loan terms. Usually, boat loan terms can extend to 10 years. The shorter your loan term, the higher your regular repayments are and vice versa.

Interest rate

The interest rate is the amount lenders charge you for taking out a loan. It’s a percentage of the principal loan amount. The interest is included in your regular repayments. This rate changes depending on the lender, the type of loan you take out, your creditworthiness, the loan amount, and other factors.

Balloon payment

The balloon payment is a lump sum that you pay at the end of the loan term. This is ideal for those who want to minimise their regular repayment amount and free up cash flow.

Repayment frequency

The repayment frequency refers to how often you make your repayments. In the boat loan calculator, you can change the frequency to weekly, fortnightly, and monthly. Analyse your financial situation and see which one best suits your needs.

What should you do when applying for a boat loan?

Keep these tips in mind before taking out a boat loan:

- Prepare your documents. Get your identification, bank statements, and other important documents ready when applying for a boat loan. Having these on hand can save you time and streamline the application process.

- Maintain a good credit score. A good way to get the cheapest boat finance is by having a high credit score. If you have a low credit score, find ways to improve it before applying for a boat loan for the best results.

- Do your research. Look at different boat loans on the market. Shop around different lenders to find a loan that matches your needs.

Find the cheapest boat finance in Australia

Let Aussie Boat Loans help you get the best low-rate boat loan in Australia. For a hassle-free boat loan application, get in touch with us! Call 1300 889 669 or get in touch with us here.

FAQ

Boat loan terms can vary from lender to lender. Some may last for five to seven years while others for over a decade. It depends on the amount you’re borrowing and the type of loan you’re taking out.

You don’t need to put down a deposit for most boat loans. Lenders can help you fund the full purchase price of the boat you’re planning to buy.

Using a boat loan calculator, you can calculate a boat repayment plan that takes into consideration the interest rates, deposit or trade-in value, balloon payment, and more.

A good credit score for a boat loan is somewhere from 550 and above. You can still get a boat loan with bad credit; however, you may pay higher interest rates.

Usually, interest rates on boat loans come at around six to seven per cent. However, other factors such as the borrower’s creditworthiness, loan amount, and the like can affect the total interest rate of the boat loan.

This is a type of loan that helps borrowers purchase a boat, jet ski, or other personal watercraft and marine vehicles. Boat loans can be secured or unsecured and with fixed or varied interest rates depending on the lender.